Roth Ira Contribution 2024 Date

Roth Ira Contribution 2024 Date. However, you’re able to continue making contributions toward an ira until the tax deadline for that year. The roth ira income limit to make a full contribution in 2024 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

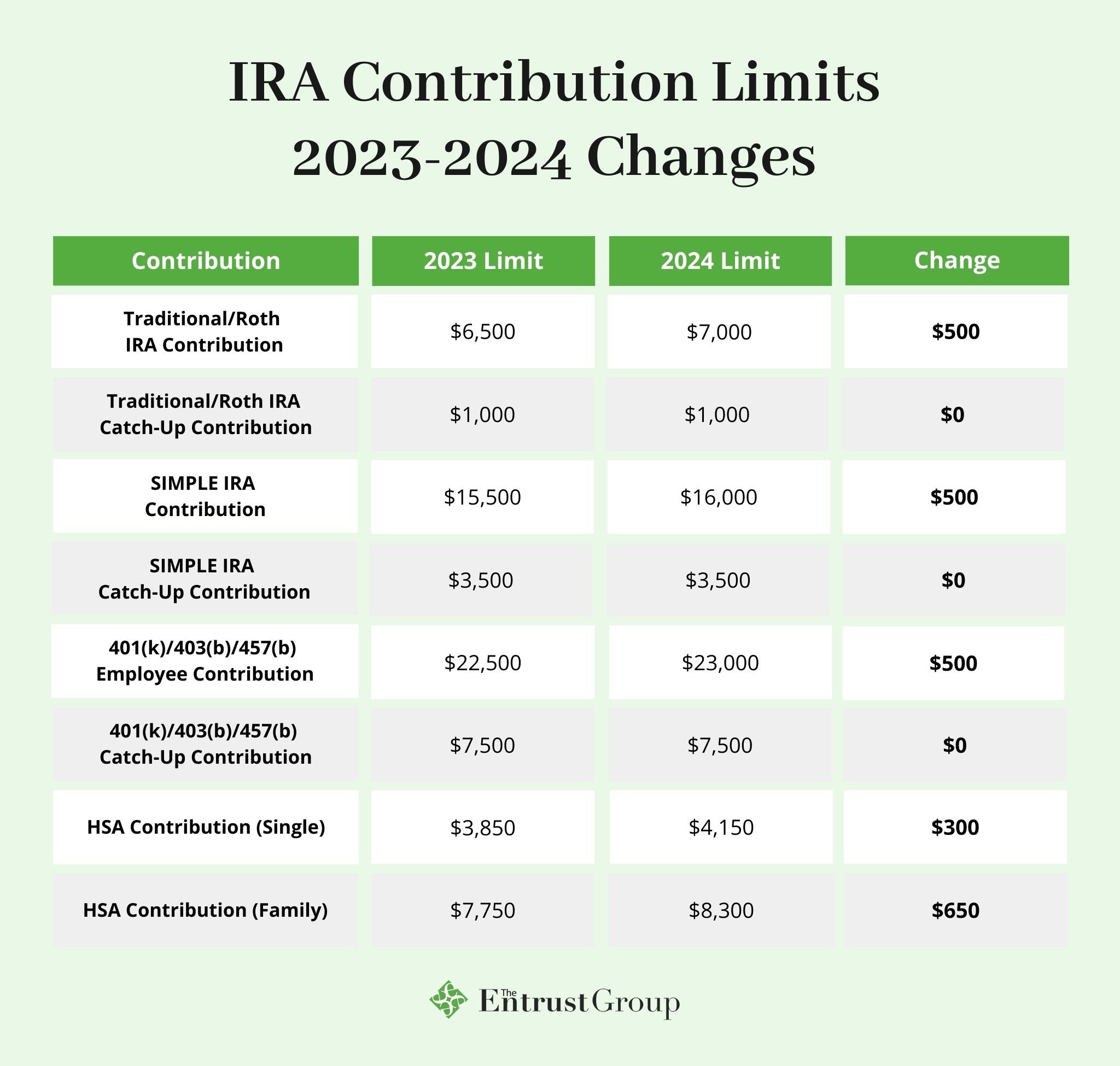

Those over 50 can still contribute up to $1,000 more in 2024, meaning that. The 2023 contribution deadline for roth and traditional iras is april 15, 2024.

Roth Ira Contribution 2024 Date Images References :

Source: cheridawgail.pages.dev

Source: cheridawgail.pages.dev

2024 Ira Contribution Limits Kacy Sallie, $7,000 if you're younger than age 50.

Source: kathiewaimil.pages.dev

Source: kathiewaimil.pages.dev

2024 Roth Ira Contribution Limits Irs Donna Donella, Ira account holders can contribute up to $7,000 in 2024, which is a $500 jump over the 2023 cap.

Source: darynqmaritsa.pages.dev

Source: darynqmaritsa.pages.dev

Roth Ira 2024 Max Contribution Letty Olympie, This increased by $500 from 2023.

Source: tierneywretha.pages.dev

Source: tierneywretha.pages.dev

2024 Roth Ira Contribution Limits Binnie Lethia, The fidelity total market index fund (fskax) and the fidelity u.s.

Source: juliannawblanca.pages.dev

Source: juliannawblanca.pages.dev

Roth Ira Conversion Rules 2024 Cammy Corinne, You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2024.

Source: wendiqshelby.pages.dev

Source: wendiqshelby.pages.dev

Roth 401 K Contribution Limit 2024 Lok Una Lindsey, For 2023, taxpayers began making contributions toward that tax year’s limit as of jan.

Source: www.sarkariexam.com

Source: www.sarkariexam.com

Roth IRA 2024 Contribution Limit IRS Rules, Limits, and, The contribution limit for a roth ira is $6,500 (or $7,500 if you are over 50) in 2023.

Source: noelaniwcharis.pages.dev

Source: noelaniwcharis.pages.dev

2024 Roth Ira Contribution Limits Chart Paule, If you’re a single filer,.

Source: pippabkandace.pages.dev

Source: pippabkandace.pages.dev

Roth Ira Catch Up Contributions 2024 Libbi Othella, While investors can contribute $23,000 ($30,500 if they’re age 50 or over) to a roth or traditional/pretax 401 (k) account in 2024, aftertax 401 (k) contributions.

Source: pippabkandace.pages.dev

Source: pippabkandace.pages.dev

Roth Ira Catch Up Contributions 2024 Libbi Othella, To max out your roth ira contribution in 2024, your income must be: